Redefining Obesity as a Chronic Disease

Once seen as a lifestyle issue, obesity has now moved to centre stage – redefined as a chronic disease and a multi-billion-dollar battleground for innovation and investment. Viral TikTok trends (#Ozempic, #Mounjaro), celebrity endorsements, and surging investment have thrust GLP-1 receptor agonists into the spotlight. But beyond the hype lies a more urgent and complex story: a global shift in how we understand and treat obesity.

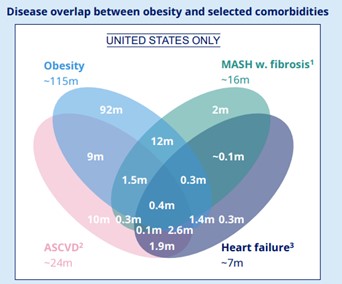

At this year’s American Diabetes Association (ADA) conference in Chicago, the message was clear: obesity is not simply a standalone condition; it is a powerful risk multiplier driving a silent comorbidity crisis. From type 2 diabetes (T2D) to metabolic dysfunction-Associated steatohepatitis (MASH), hypertension, and heart failure with preserved ejection fraction (HFpEF), obesity lies at the root of many of today’s most burdensome chronic diseases (Figure 1). Experts called for a fundamental reframing: treat obesity early, not reactively, and intercept disease progression before it cascades. GLP-1 receptor agonists have emerged as transformative tools in this paradigm, positioning obesity care at the forefront of public health strategy.

Globally, about 900 million people could benefit from GLP-1 therapies targeting obesity, a number that underscores the scale of unmet need and market opportunity. The race to capture this market is intensifying, with industry leaders like Novo Nordisk and Eli Lilly taking an early advantage, rapidly expanding GLP-1 indications across cardiometabolic conditions and accelerating next-generation assets. Meanwhile, smaller biotechs such as Altimmune are attempting to carve out their own niche – targeting obesity-linked diseases like MASH and obstructive sleep apnea (OSA), or advancing novel delivery formats – proving that even a sliver of this market holds multi-billion-dollar potential.

Figure 1: The relationship between obesity and related comorbidities in the US.

Oral GLP-1s: Democratising Access to Obesity Treatment

Despite over 40% of US adults being classified as overweight or obese, only about 6% of eligible patients currently receive treatment. Among those who do initiate GLP-1 therapy, long-term adherence is low, with just 24-30% remaining on treatment beyond two years. Much of this attrition stems from injection fatigue, the logistical burden of regular healthcare visits, high costs, and cold-chain storage requirements, all of which limit accessibility.

Against this backdrop, the market is increasingly shifting towards more personalised weight loss treatments, given not all patients require a 20-25% reduction in weight, particularly those who are not morbidly obese. These evolving needs open the door for a pill version of GLP-1 therapies and may enable patients with lower BMIs to start earlier on oral therapies, preventing them from reaching high BMI levels and mitigate the need for 20-25% weight loss delivered by injectable GLP-1 therapies. Several late-stage oral candidates are emerging, offering once-daily or even extended-duration formulations that could simplify treatment and offer greater scalability through more efficient distribution and manufacturing; this is especially valuable in markets with limited injectable infrastructure and could help expand global access.

At ADA 2025, Lilly presented the first Ph3 ACHIEVE-1 data for its highly anticipated small molecule oral GLP-1 – orforglipron – for T2D. Whilst Novo’s Rybelsus (oral semaglutide) has been available for T2D for several years and is expected to enter the obesity market in Q4 2025 with a first-mover advantage, Lilly’s orforglipron offers a notable edge as a small molecule therapy that comes without food or water restrictions, unlike peptide-based oral therapies. Additionally, the Ph3 ACHIEVE-1 trial also showed 8% weight loss (yet to reach weight loss plateau), though this positive signal did not fully translate into Lilly’s recently announced topline data from the Ph3 ATTAIN-1 trial in weight management, with the highest dose achieving a 12.4% body weight reduction at week 72; full ATTAIN-1 data are expected at EASD 2025. Despite this, Lilly appears confident in the profile of orforglipron and is preparing for a broad commercial rollout given the company has committed $548 million to pre-launch inventory, signalling readiness for scale up, with analysts noting there is “no gating due to supply”.

While oral GLP-1 therapies offer improved dosing convenience and scalability, once-daily regimens may lead to missed doses and lower adherence; this is compounded by limited reimbursement coverage, as many US health plans still do not cover weight management treatments, making consistent access difficult when patients switch jobs or insurance plans. This is especially critical given weight management is a chronic condition, where maintaining weight loss requires long-term adherence, or else weight regain is likely. Ultimately, the obesity market will only shift towards oral ‘next-generation’ GLP-1 therapies as the first-line treatment if they can achieve the 15-20% weight loss benchmark seen with injectable tirzepatide, and secure broad payer support.

Weight Loss, But at What Cost? The Safety Challenge

The surge in GLP-1 use has brought unprecedented visibility to drugs like Wegovy (semaglutide) and Zepbound (tirzepatide). But as usage rises, with obesity expected to affect nearly half of US adults by 2030, so too does scrutiny around safety and tolerability.

Gastrointestinal (GI) side effects remain the most significant hurdle. In real-world use, around 68% of patients on Wegovy discontinue within a year , with GI events like nausea, vomiting, and diarrhoea cited as the top reasons. As the obesity market becomes increasingly crowded, the next generation of obesity drugs must ensure that they not only provide high efficacy but also provide long-term tolerability; any compromise in tolerability for additional efficacy will likely be shunned across the board by payers, prescribers, and most importantly, by patients.

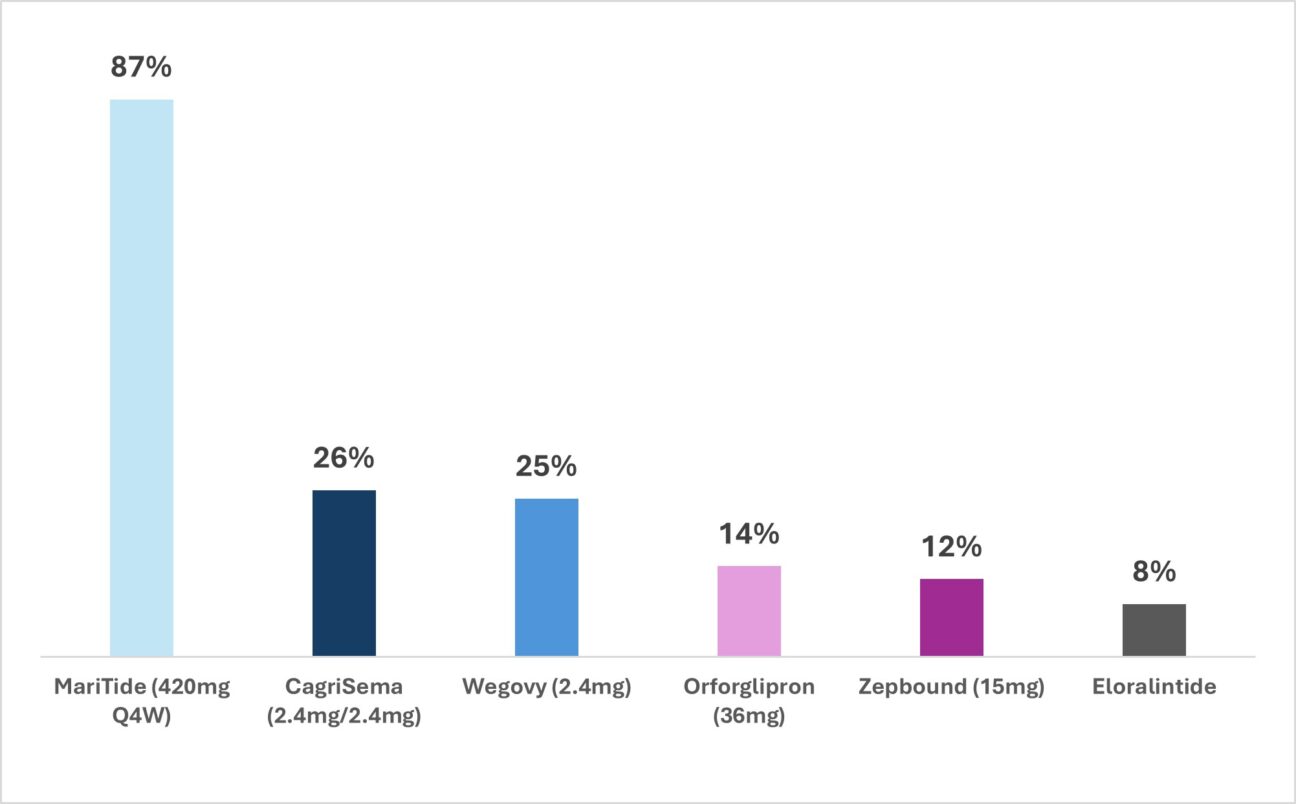

Looking to the future, novel therapies will be benchmarked against Zepbound which currently sets the gold-standard for safety achieving a vomiting rate of up to ~12% in the pivotal Ph3 SURMOUNT-1 obesity study (Figure 2). In contrast, at ADA 2025, Amgen’s MariTide, a GLP-1 agonist/GIP antagonist monoclonal antibody, raised eyebrows with an 87% vomiting rate at the highest dose. This underscores the importance of careful titration and formulation refinement to minimise unwanted side effects for patients on treatment.

To optimise safety, two key strategies are emerging: develop assets with novel mechanisms of action that reduce GI-burden or personalise treatment titration algorithms. Companies like Lilly and Novo are exploring the former option with both companies presenting early-stage data at ADA 2025 for their alternative asset classes, such as amylin agonists, which may offer improved GI tolerability versus current incretin therapy (as well as potential benefits such as lean mass preservation); notably, Lilly’s eloralintide (an amylin agonist) demonstrated a vomiting rate below 10% (Figure 2). On the latter point, Amgen presented its amended dosing regimen and increased titration period of MariTide going into Ph3 development in hopes of addressing its tolerability issues.

Figure 2: Comparison of vomiting rates across oral and injectable obesity drugs

The Next Frontier: Driving ‘Quality’ Weight Loss

While we have seen early messaging on the “quality” and “composition” of weight loss from both Regeneron and Novo Nordisk, ADA 2025 was the first conference in which key late-stage clinical data on lean mass preservation was presented for both amylin/GLP-1 fixed-dose combination (CagriSema) and novel GLP-1 + activin mAb (semaglutide + bimagrumab) combination approaches.

Quality weight loss (defined as preferential loss of fat mass while preserving lean muscle) appears to be becoming a future trend for next-generation weight loss assets given current incretin therapies can lead to ~33% of weight loss coming from lean muscle, which is harder to regain and can compromise strength, mobility, and overall health, particularly in older patients.

At ADA 2025, the benefit of Novo’s CagriSema (cagrilintide + semaglutide) was met with scepticism given the anticipated lean mass preservation benefit was not demonstrated during its Ph3 REDEFINE-1 data presentation. In contrast, Eli Lilly generated a strong buzz from its Ph2 BELIEVE trial data showing an impressive 0% lean mass loss with bimagrumab monotherapy and <10% lean mass loss when combined with semaglutide, compared to ~28% loss with semaglutide alone.

Following on from ADA 2025, questions around lean mass preservation remain, notably does preserving lean mass translate to real-world benefits for patients? While bimagrumab showed lean mass preservation, it did not show significant improvement in grip strength over semaglutide alone, raising doubts about the real-world functional outcomes for patients. Additional uncertainties around lean mass preservation that must be addressed going forward include:

- Are patients and HCPs concerned about lean mass preservation, or is it an academic endeavour

- Will payers be willing to pay for an add-on or novel therapy that preserves lean mass but does not show improvement in strength or reduction in fall risk?

- Will the FDA recognise formal endpoints that measure lean mass preservation?

- Is lean mass preservation a true unmet need or simply a differentiation point for novel assets?

While companies like Novo, Lilly, and Regeneron are including therapies that target optimising the composition of weight loss in their portfolios, the immediate focus remains on demonstrating efficacy against key comorbidity endpoints such as major adverse cardiovascular events (MACE), heart failure, and the apnea-hypopnea index (for OSA) through a plethora of trials. As the market becomes increasingly saturated, and more data emerges on treating obesity-related comorbidities, payers may shift from reimbursing solely for weight loss to seeking to maximise healthcare value and cost savings across a broader range of indications, such as T2D and MASH.

Personalising Obesity Care Through Patient Segmentation

As the obesity drug landscape expands, a one-size-fits-all approach is no longer sufficient. Personalisation by BMI tier, comorbidity, and treatment response is emerging as a critical strategy to improve outcomes and optimise access.

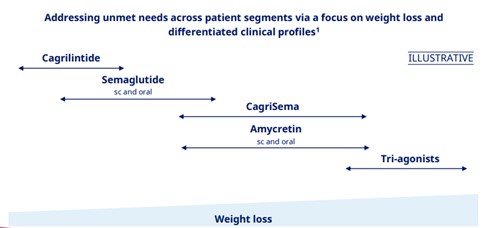

Following ADA 2025, Novo outlined a segmentation framework based on BMI (Figure 3):

- Low BMI: GLP-1 monotherapy remains first-line

- Medium BMI: GLP-1/amylin combos (e.g., CagriSema, Amycretin) offer increased efficacy

- High BMI or treatment-resistant: Triple agonists or advanced combinations may drive >20% weight loss

Segmentation by comorbidity is also gaining traction. Patients with obesity and overlapping conditions, such as type 2 diabetes, MASH, hypertension, or HFpEF, are more likely to access treatment via payer support, given the broader clinical value. Novo showcased this approach through data from several trials including SOUL (CV outcomes), STRIDE (functional outcomes), and FLOW (renal outcomes).

Safety and tolerability is also a key lever in personalisation. Novo emphasised CagriSema’s flexible dosing strategy, allowing clinicians to titrate doses up or down based on patient response and tolerability, which is especially valuable for managing GI side effects – a key reason for GLP-1 discontinuation. In real-world settings, where patients often have varying sensitivities and multiple comorbidities, personalised dosing could improve adherence, reduce dropouts, and sustain long-term outcomes.

Ultimately, Novo and Lilly having an extensive pipeline, likely to segment patients, enables smarter and more targeted treatment, ensuring the right patients get the right therapy at the right time.

Conclusion: Redefining the Future of Obesity Care

ADA 2025 made it clear, personalised obesity treatment looks to be the next wave in obesity care, driven by preventing patients’ comorbidities and matching therapy to the quantity of weight loss being sought. In addition, as GLP-1 receptor agonists become central to this new paradigm, the next wave of innovation, particularly in oral delivery, safety refinement, and potentially lean mass preservation, is poised to redefine first-line care.

From a pharmaceutical perspective, the key objective for new players is likely to focus on carving a niche in the obesity market that is targeted towards a specific patient type segmented by factors such as BMI, lean mass preservation, comorbidity profile, or sustaining weight loss after cessation of therapy. Alongside personalising treatment options, the future of obesity care will also depend on outcomes beyond weight loss such as improving safety, adherence, and the long-term health of patients.